20+ Home loan repayments

Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. By yourstory हनद September 20 2022 Updated on.

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Here you can check how much emi per month you have to pay for 20 lakh of home loan amount.

. President Joe Bidens student loan forgiveness plan forgives up to 20000 in student loans for Pell Grant recipients and 10000 for those holding federal loans. A rate cut of 025 on a R1 million home loan can save. Thats an additional 36522 on monthly.

Choose Smart Apply Easily. Reduced repayments for up to 6 months. Compare More Than Just Rates.

If your home loan has a redraw facility you can build up a balance over time of say. You have a variable rate home loan. While both loan types have similar interest rate profiles the 20-year loan typically offers.

If you make your home loan repayment you will not be able to avail income tax benefits. Compare Offers Side by Side with LendingTree. Ad Consolidate Your Debt Or Make Home Improvements With A Cash-Out Refinance.

Here are some of the advantages of a 20-year mortgage over a 30-year mortgage. Our loan repayment calculator will help you determine what you might pay each month as well as overall interest incurred. It can also help you determine line payment options and rates.

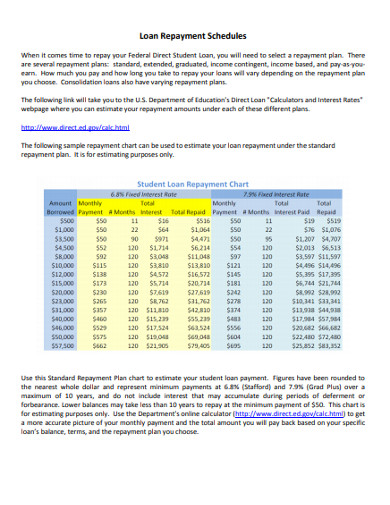

A 30 year bond means lower monthly repayments with a higher interest rate while a 20 year bond means higher monthly repayments with a lower interest rate. In fact a great trick is actually to save up for a holiday by making extra repayments on your home loan. Ad Find The Best Home Equity Rates.

There are a number of home loan repayment options that you could consider. Special Offers Just a Click Away. And will pay Lenders Mortgage Insurance LMI when the customer has.

Top Lenders Reviewed By Industry Experts. Ad Explore Quotes from Top Lenders All in One Place. Get the Right Housing Loan for Your Needs.

Insert the price of the property you wish to purchase and we will calculate how much your total monthly repayment amount will be. Make the required repayments and the ability to pay off the loan without substantial hardship. From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration.

Currently you can claim tax exemption of upto Rs 15 lakh per year on principal amount. Find A Lender That Offers Great Service. Ad Compare the Best Mortgage Lender To Finance You New Home.

Simple techniques like one extra EMI payment every year or an increase in EMI by 5-10 every year can help you reduce your interest burden by up to 50 and repay a 20-year. By choosing a 25-year loan term instead of a 30-year term your monthly repayments would be. Find out your estimated home loan repayments as well as ways to pay off your home loan faster.

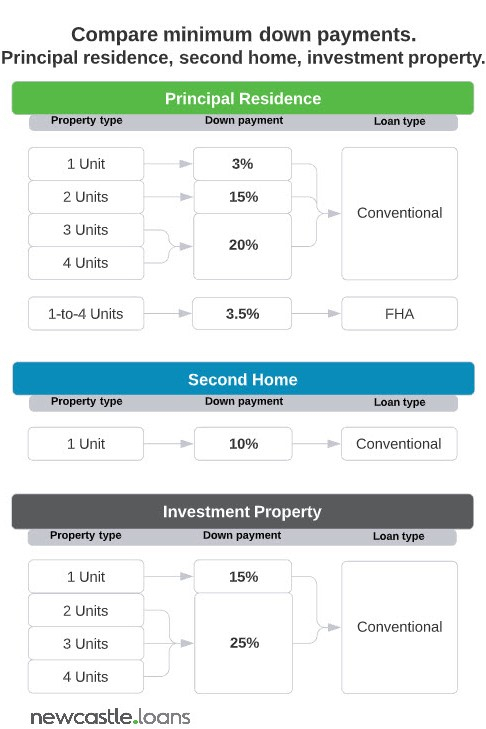

It uses the purchase price of the property and the current interest rate to tell your home loan amount and monthly repayment. Begin Your Loan Search Right Here. The Repayment Calculator can be used for loans in which a fixed amount is paid back periodically such as mortgages auto loans student loans and small business loans.

Ad Reduce Debt With Best BBB Accredited Debt Relief Programs. 2022s Best Home Equity Loans Comparison. Ad Give us a call to find out more.

One of our home loan specialists can visit at a time that. ANZ Home Loans are available for periods between of at least 1 year and up to 30 years in duration. Calculate your home loan repayments today.

Check per month emi calculations for 51015202530 years of repayment period. Tue Sep 20 2022 074336 GMT0000. This is sometimes called the amortisation schedule of.

Mortgage repayment reduction allows you to reduce your home loan repayments by 50 for up to 6 months. If youve had your loan for at least 12 months and are looking for a short-term solution a period of reduced repayments could get you back on track. Calculate your home loan repayments.

Ad Give us a call to find out more. The Bondspark Home Loan Repayment Calculator will help you find out how much your monthly repayment totals will be. Ad Leverage Your Homes Equity With PNCs Home Equity Loans and Lines of Credit.

ANZ Home Loans are available for a minimum of 20000 for new Standard Variable. You could be eligible for this if. 261 rows The 20-year fixed mortgage lies in the middle with a higher monthly payment of 176309 compared to 139787 on a 30-year term.

Through the middle of 2018 homeowners. Type of mortgage Variable Repayment types Principal Interest Availability Owner Occupier Repayment options Weekly Fortnightly Monthly Special Offers 3000 cashback for. Our bond repayment calculator helps you plan and budget.

Why Making Monthly Payments On A Repayment Mortgage Is A Form Of Saving Monevator

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Simulated Loan Repayment Schedule Of Education And Home Loan In State Download Table

Downloadable Free Mortgage Calculator Tool

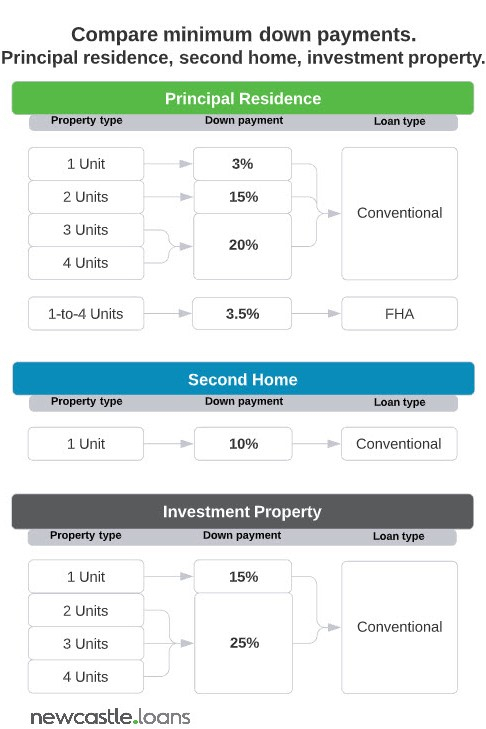

Principal Residence Second Home Or Investment Property How Occupancy Affects Your Mortgage

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

Downloadable Free Mortgage Calculator Tool

Repayment Schedule 10 Examples Format Pdf Examples

How To Complete My Home Loan Within Ten Years Quora

I Made A Simple Google Sheet To Compare A Traditional Loan Repayment Vs A More Aggressive Strategy On Interest R Financialindependence

Eagerly Awaiting The President To Wipe Out 10k Deb Myfico Forums 6565797

Average Jasso Loan Repayments And Repayment Burdens At The 20th Download Scientific Diagram

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

At Halfway Stage 10 Years Of A 20 Year Home Loan Would The Loan Amount Still Pending Be Half Less Than Half Or More Than Half Of The Total Quora

Getting A Mortgage While On Income Based Repayment Ibr

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide