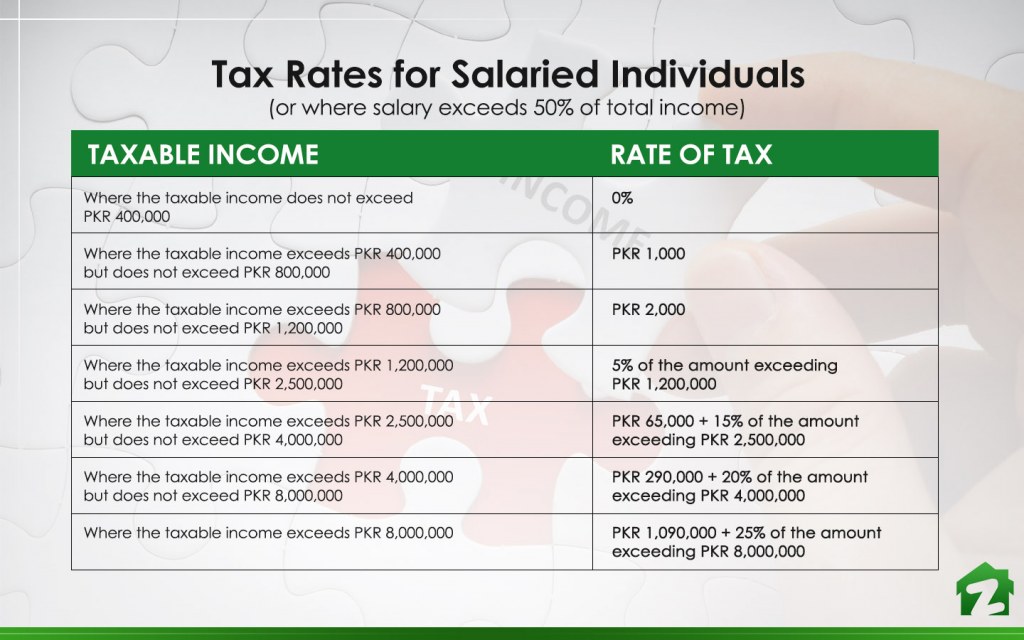

14+ Income Tax Rate 2018-19 Pakistan

Pakistan levies tax on its residents. A domestic company is taxable at 30.

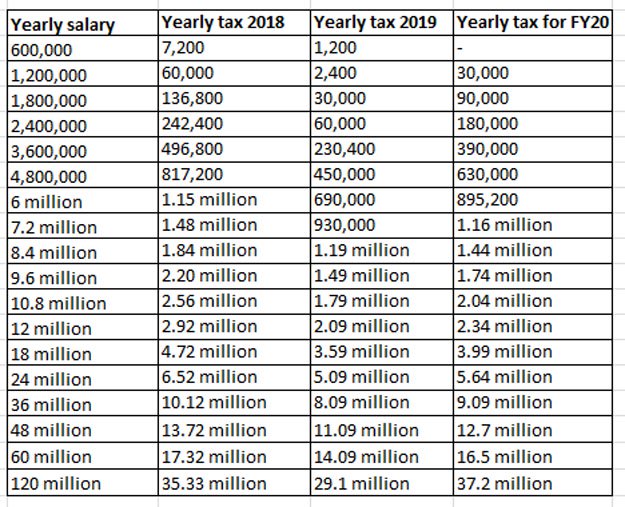

Budget 2019 20 Salaried Class To Pay More Taxes Under Pti Govt Profit By Pakistan Today

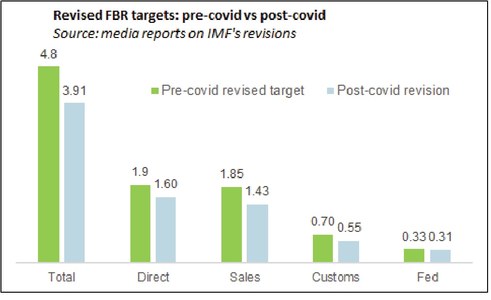

Web Income Tax Returns in Million 189 GOVERNMENT OF PAKISTAN MINISTRY OF FINANCE REVENUE DIVISION ISLAMABAD 156 267 TY-2016 TY-2017 TY-2018.

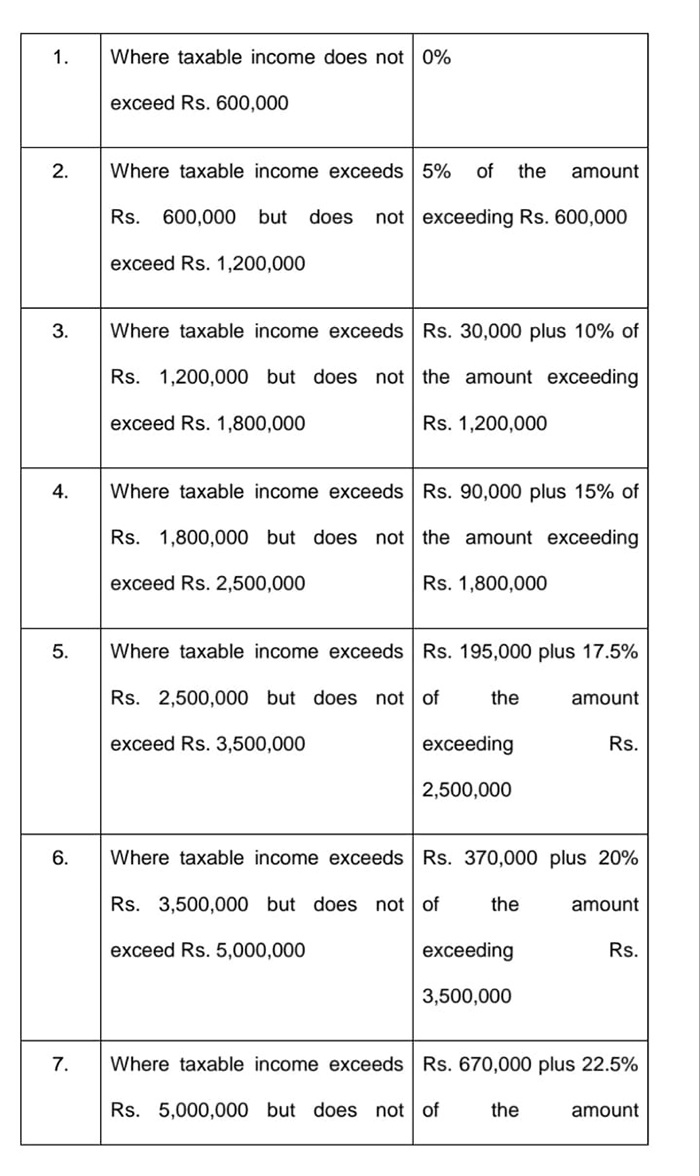

. Web This rate card is being edited by Mr. The Finance Act has revised the rate for a banking company with zero rate for. Web As per income tax exemption bill passed by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2018-2019.

Tax Slab Rate for Domestic Company. Web Tax Calculator for TY 2018-19. Tax Laws Amendment Ordinance 2016.

For tax year 2014 tax rate for companies other than banking companies shall be 34 and for banking companies it will be 35. 12 of tax where total income exceeds Rs. Is defined in section 101 of the Income Tax Ordinance 2001 which caters for Incomes under different heads and situations.

Hussain Mehmood Manager Taxation and Corporate Services. Income Tax Amendment Ordinance 2018. However the tax rate is 25 if turnover or gross receipt of the company does not.

Web Tax Rates 2018-2019 Year Residents The 2019 financial year starts on 1 July 2018 and ends on 30 June 2019. Web Tax Calculator Pakistan 2018-19. Please write your salary income in the fields provided below to calculate your Income Tax in Pakistan.

The financial year for tax purposes for individuals. Web As per the Finance Act 2018-19 approved by Government of Pakistan this web based tax calculator applies. 4 of tax plus surcharge.

All you need is to calculate your annual income because these slabs represent annual incomes. KCO Rate Cards 2018-19 040718 By admin 2018-07. Web Some of the common.

Web It is a frequently asked question. Web Corporate Tax Rates in Pakistan. Web As per the Finance Act 2018-19 approved by Government of Pakistan this web based tax calculator applies income tax rates in Pakistan on taxable income of.

It is simple to locate your slab. Tax Slab Rate for Domestic Company. Tax Calculator for TY 2018-19.

Web If you are a salaried person living in Pakistan these income tax slabs will guide you about the tax you should pay as per the Income Tax Rules 2017-2018. Income tax collection from salary persons has fallen sharply by 43 percent in fiscal year 201819 due to incentive granted by the previous PML-N. Ordinance No XV of.

Web 10 rows Last reviewed - 22 July 2022. Web Pakistan source Income. Web Income Tax Ordinance 2001 Amended upto 30-06-2018.

Web The Personal Income Tax Rate in Pakistan stands at 35 percent. A domestic company is taxable at. Some of the common.

Personal Income Tax Rate in Pakistan averaged 2324 percent from 2006 until 2022 reaching an all time high. KCO Rate Cards 2018-19 040718 By admin 2018-07. 4 of tax plus surcharge.

Sustainability Summit

Income Tax Rates In Pakistan 2020 21 Blog Filer Pk

Lfc Nike Little Kids Home Kit 22 23

Tax Collection A Tale Of Haves And Have Nots Perspectives Business Recorder

Federal Budget 2019 20 Minimum Taxable Income Revised For Salaried Non Salaried People

Test Blog Yeni Sohbet S O H B E T Balci Academia Edu

Tax Collection A Tale Of Haves And Have Nots Perspectives Business Recorder

Fbr Taxes Reading May Collection Br Research Business Recorder

June 3 2018 By Nagaland Post Issuu

For 2018 19 2020 2021 Mercedes S550 S63 Dashboard Air Vent W222 Interior Ambient Ebay

Pakistan Budget Fy 2019 20 Income Tax Measures World News Observer

Pakistan Salary And Income Tax Calculator For Year 2018 2019

Tax Calculator Pakistan 2022 2023

149 Tax On Salary Income 2017 18 Fbr Withholding Tax Card Updates

All About Tax Brackets In Pakistan For 2019 Zameen Blog

Minutes Of March 30 2022 Mar 08 2022

How Do Pakistani And Indian Stock Markets Compare To Each Other Quora